Impacts of CBDC on Malaysian economy

A kind of money that is not in physical form and is only available digitally is the new technology rising each day. Digital money is only created, secured, and transmitted electronically.

The digital currency has left strong footprints in evolving financial sectors across the globe. The adoption of digital money is gaining momentum and the utilization of cash is declining. Several countries planned, executed, and succeeded in research projects concerning the adoption of digital currency to advance their financial systems. With time digital currency is contributing to the evolution of payment systems and enhancing financial inclusivity globally.

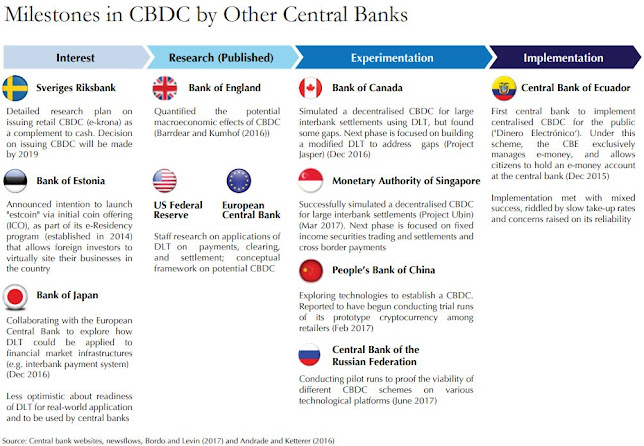

The Central Bank of

Japan, the US Federal Reserve systems, The Central Bank of Bahamas, the Riksbank

of Sweden, The European Central Bank, and many other renowned central banks of

different countries had remarkable success in adopting digital currency and

initiated projects to launch Central Bank Digital Currency (CBDC).

The Bank Negara

Malaysia (BNM) advanced alongside and initiated strong practical steps to

advance its digital technological evolution of payment systems. Over the last

decade, there is a rising trend of digital payment adoption has been observed

among the people of Malaysia. Furthermore, the landscape of digital payment

providers is also increasing.

Effects of Digital Currency on the Digital Economy:

In the past few years,

data shows that the Malaysian government aimed to promote digital currency

footprints, accelerate peer-to-peer lending, and secure investors in digital

asset trading. In 2019, the government also declared the adoption of

cryptocurrency law, and in 2020 the Bank Negara Malaysia initiated working on

digital asset policies and cryptocurrency regulations. Overall, the country’s

goal is to foster sustainable innovation.

Where does Malaysia stand out

economically today?

Malaysia is known to

have the 25th most competitive economy in the world, standing at the

index of 42nd freest economy as per the database of 2023. Its

economic freedom score is 67.3 and its growth ratings stand above the average

in the Asian-Pacific region. Although

the present situation of the world is challenging, research indicates that the

Malaysian economy is expected to grow 4-5% in the year 2023

Role of

Cryptocurrency in Malaysia:

Currently, research states that although Cryptocurrency is

legal and regulated in Malaysia, its authorities are still doing homework to

understand and launch digital currency operationalization.

In 2020, the Malaysian Securities Commission modified digital assets guidelines and that left a strong impact on its users. These guidelines enabled companies to obtain funding by issuing tokens and ensured a proper framework that can help prevent fraudulent activities.

CBDC: What’s the current status and how it can

impact the Malaysian economy?

Malaysia has proved

itself as a strong and hardworking economy over the last few years with its

strong and effective policies. Some of the noteworthy research findings reveal

that Central Bank Digital Currency (CBDC) may have strong impacts on its

economic system. However, at the current moment, BNM has no clear stance or

notification in officially issuing CBDCs. However, research provides some

wonderful analysis about the usage and adoption of digital currency. Let’s have

a look:

As per the global

research analysis about the issuance and operationalization of CBDC, it is

proven that this technology holds the power to minimize cost, efficient payment

systems, and integrate a larger population into the financial systems of a

country. In the case of Malaysia, experts discover that the Malaysian private

sector can be inclusive with an efficient and vibrant payment landscape.

To inaugurate and issue

the CBDC, BNM has established vigilant efforts and research endeavors to

transform its technical and policy frameworks. BNM has also started working on

enhancing infrastructure and resource capacities and an assessment to conduct

and critical analysis of the CBDC issuance by other central banks globally.

Additionally, the authorities are also working on risk mitigation and effective

surveillance networks to avoid theft and digital robberies.

Malaysian economy can

boost and achieve its public policy objectives at the same time by

strengthening its financial sector and advancing innovation in payment systems.

However, there is a dire need to sustain economic growth as per the current

situation of global crises. The issuance of CBDC can elevate cyber risks,

impact monetary policies, and affect overall financial stability. Furthermore,

as financial risk is becoming vulnerable due to the current global situation,

people can shift to foreign CBDC and this can further increase the threat of

currency substitution.

Concluding Remarks:

Each country has its own set of priorities,

distinct circumstances, and different economic conditions. For centuries,

people have used cash for the buying and selling of products and services.

Today, with the rising technological innovations each passing day, cashless

payments are being taken as a new alternative and feasible approach by its

users. Malaysia has the potential to implement robust precautionary measures

and improve its digital currency adoption situation like many other countries.

Khuram Shahzad

Comments

Post a Comment